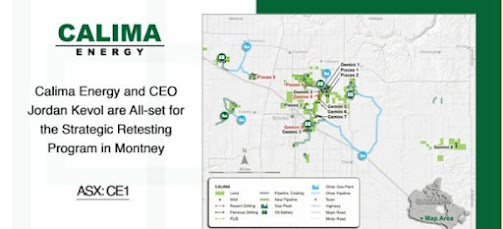

CALIMA ENERGY (ASX: CE1) unveils the initiation of an effective testing program on the two long-reach horizontal Montney wells drilled and partially tested in 2019 on the Calima Lands. With this, Calima Energy and CEO JORDAN KEVOL intend to de-risk the project and are expected to generate a higher value for the asset, aiming to complete a joint venture, partnership, or trade sale.

The operation of one of the top-tier mining companies in Australia will gauge the gas and condensate flow rates of the Middle Montney Formation in Calima #2. In addition, it will allow for a longer-term test on the Upper Montney in the Calima #3 well. The abundance of condensate and NGLs will further upscale the project economics for prospective CALIMA ENERGY PROJECTS. Currently, the project is funded by cash flow derived from the production activities in the Brooks and Thorsby assets, with current production of around 4,500 boe/d. The latest Calima Energy share price is AUD0.145.

Due to the early spring breakup, Calima #2 and #3 wells’ production testing was cut short after the fracture stimulation of the two Montney horizontal wells in 2019. The spring breakup further necessitated the demobilisation of the heavy machinery, which led to ambiguous and inconclusive test results. However, such concerns will be duly eliminated in the forthcoming Calima Energy projects as a specific strategy for a permanent access road to the main highway shall be in place.

The testing of the Middle Montney in Calima #2 allowed only a 16% recovery of the frac load, which was considered the peak potential gas rate. Before the end of the testing program, the well flow was tested at 10.2 mmcf/d and 103 bbl/d condensate (approximately). However, re-testing the well will uncover the ultimate potential of this zone in addition to the associated condensate rates, which the original test may still need to look into.

The Upper Montney well (Calima #3) was tested for a relatively short period, resulting in a minimal frac load fluid recovery of 5% before the final termination of the testing. While the 2019 production testing rates of the Calima #3 well barely revealed its potential, the additional testing program planned for Q1-2023 is estimated to uplift the ENERGY COMPANY’S detailed reservoir work that points towards a significant condensate resource within the Upper Montney at Tommy Lakes.

Condensate is a light and high API value oil that attracts premium pricing in the Canadian market, usually in the range of WTI pricing.

Comments

Post a Comment